FAT32 takes the costs out of compliance with £350,000 first investment from the Venture Sunderland Fund

Northstar Ventures has ignited its new Venture Sunderland Fund leading a £625,000 investment round into FAT32, a company making exciting changes in the regulatory tech industry.

The words ‘compliance’ and ‘innovation’ are rarely found in the same sentence. However, FAT32 is transforming cyber-security compliance from a lengthy chore into an effortless process, with potential cost savings of up to 70%. Customers using the company’s flagship innovation OneClickComply®, can complete compliance tasks up to 20 times faster than the traditional method of calling in costly external consultants, with the cutting edge software automating the implementation of major cyber and data security protocols.

– examines the customer’s current processes against major compliance standards such as Cyber Essentials, ISO 27001 and GDPR, highlights any areas in which they are deficient and then offers a highly innovative automated implementation process to resolve any issues. It is compatible with most major software providers, including AWS, GCloud and Azure and provides a clear audit trail for third parties, helping to take the headache out of year end. FAT32 is offering customers compliance in days rather than months and in a much more cost-effective way.

The UK cyber-security market was estimated at £11bn in 2023 and is expected to almost double to £20bn by 2029, with growth being driven by increasingly sophisticated cyber attacks, alongside regulatory interventions. Cyber security is becoming a board level matter in many organisations, with the consequences of a breach or non-compliance being substantial.

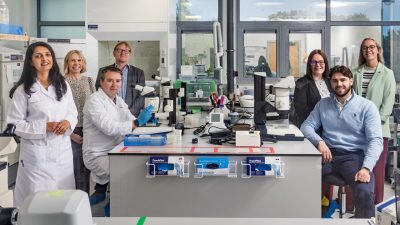

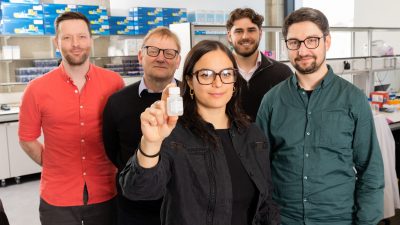

The founding team of Connor Greig, Conor Sizeland and David Warren share a passion for emerging technologies and have used their collective experience in software engineering and cyber security to create a trailblazing solution. The founding team are supported by Chairman, Kelvin Harrison, former Chair of Sunderland-based Clixifix and advisor, Jamie Whitcombe-Jones (ex CISO at Allianz).

Northstar Ventures’ investment comprises £350,000 from the Venture Sunderland Fund and £200,000 from the North East Innovation Fund, supported by the European Regional Development Fund, alongside angel investors. The funds will aid development of this ground-breaking software and support the expansion of the team. The company has ambitious aims to generate high-skilled jobs in Sunderland, adding to the growth of the of the cyber security cluster in the wider region.

Connor Greig, Co-Founder, FAT32 said: “FAT32 is delighted to be the first investment from the Venture Sunderland Fund. We are truly passionate about levelling up the North East by creating skilled digital jobs in the region and are thrilled to be working with Northstar Ventures to do just that.

“Cyber security is a pressing challenge that affects us all, and keeping on top of it is increasingly difficult due to the ever-evolving threat landscape. That’s why at FAT32, we have automated cyber security compliance to make it easy and affordable for all businesses. Our platform is the first to combine continuous monitoring with automated remediation. We highlight non-compliance issues and fix them automatically, helping companies navigate their compliance journey within a click, with no cyber experience required.”

Tom O’Neill, Investment Manager, Northstar Ventures said: “We are very pleased to complete our investment in Sunderland based FAT32. This is the first investment from the Venture Sunderland Fund, which has been designed to provide funding for high-potential businesses seeking to start up or grow in the city. The FAT32 founding team is impressive and has developed a leading solution to a major problem in the cyber security sector, which many business owners will be able to empathise with. We are excited to join the company on the next stage of its journey and look forward to working with them to grow the business at scale”.

Notes To Editors

Press contacts – Northstar Ventures Limited

Deborah Nixon Carr

Investment Support

M: 07754 800 749

[email protected]

Emma O’Rourke

Finance Director

M: 07715 366 434

[email protected]

About Northstar Ventures

Northstar Ventures is a long-established venture capital and social investment company based in the North East of England.

As the region’s leading early-stage investor, we have provided over £100m of funding into start-ups, early-stage businesses and high impact social enterprises.

Supporting entrepreneurs since 2004, we know how to identify strong, effective teams with innovative ideas that will drive high growth, scalable businesses, and sustainable charities. Our particular focus is on those organisations who provide solutions to societal and industry-wide issues on a regional, national and even global scale.

Our investment managers have a wealth of expertise supporting new and growing businesses. They bring commercial and operational knowledge to the table combining everything from PhDs, MBAs, international careers and finance to micro-business experience.

Northstar Ventures Limited is authorised and regulated by the Financial Conduct Authority. For more information see www.northstarventures.co.uk

About the Venture Sunderland Fund

The Venture Sunderland Fund provides investment for ambitious, high-growth companies at all stages. The fund has been established to invest in companies that will catalyse the economic growth and prosperity of the Sunderland city region.

Venture Sunderland is primarily focused on businesses in technology, advanced manufacturing and green industries that are focused on growth and creating high-quality, well-paid jobs in the city region.

Sunderland is a leading digital and creative hub, nationally recognised as a Smart City with an automotive sector that is leading the UK’s switch to electrification. One of the key aims of Venture Sunderland is to accelerate the area’s development as an innovation hub for the wider north of England.

For further information on the Venture Sunderland Fund, see Venture Sunderland Fund – Northstar Ventures

Press Contacts – Fat32 Limited

Joanne Middleton

+44 (0)191 743 283

About FAT32 and OneClickComply®

FAT32 is an innovative cyber security software company founded in 2024 and headquartered in the city of Sunderland. Designed and built by industry experts, their proprietary OneClickComply® software helps technical teams implement and maintain information security and cyber security standards such as Cyber Essentials and SOC2 Type 2.

OneClickComply® continually monitors an organisation’s compliance with a given standard’s security controls, providing insight and guidance on any non-compliance found, whilst also providing an automated fix for each issue.

This automated technical remediation of compliance issues has been proven to save organisations months of work to maintain and implement security measures. Helping at all times to maintain security standards, avoid data breaches, and protect against a rising threat of malicious actors and cyber attacks. For more information see oneclickcomply.com

Press contacts – The North East Fund

Kristen Watson

PR Account Executive

T: 0191 261 4250

M: 07718 065696

[email protected]

Sarah Banks [email protected]

Jez Davison [email protected]

About The North East Fund

The North East Fund’s suite of five venture capital and loan funds invested £128m in 433 companies between April 2018 and December 2023. The programme will continue to provide funding during 2024 to small and medium sized businesses based in the seven Local Authority areas of North East England: Northumberland, North Tyneside, Newcastle, South Tyneside, Gateshead, Sunderland and County Durham. It was established to encourage investment in, and the commercialisation of, new technologies and to stimulate new business creation, private investment and entrepreneurialism in the North East. By January 2024, over 2,700 new jobs had already been created by its investee companies. The North East Fund has overall responsibility for the programme, which is delivered through five separate funds, each managed by an independent, FCA-regulated fund manager. Details of these, and up to date information on the progress of the programme, is available on The North East Fund’s website: www.northeastfund.org

The North East Fund has been established with funding from the North East of England European Regional Development Fund programme, the European Investment Bank and from returns on previous North East based, publicly supported investment funds. It is jointly owned by the seven North East local authorities.

About the European Regional Development Fund

The North East Fund will receive up to £78,500,000 of funding from the England European Regional Development Fund as part of the European Structural and Investment Funds Growth Programme 2014-2020. The Department for Levelling Up, Housing and Communities is the Managing Authority for European Regional Development Fund. Established by the European Union, the European Regional Development Fund helps local areas stimulate their economic development by investing in projects which will support innovation, businesses, job creation and local community regenerations. For more information visit https://www.gov.uk/european-growth-funding.

About the European Investment Bank

The European Investment Bank (EIB) will lend up to £60,000,000 to the North East Fund programme. The European Investment Bank is the long-term lending institution of the European Union owned by its Member States. It makes long-term finance available for sound investment in order to contribute towards EU policy goals. For more information, visit: http://www.eib.org/about/index.htm