Northstar Ventures has backed Newcastle-based Nanovery with investment from two of its funds; £450,000 from the North East Innovation Fund, supported by the European Regional Development Fund, and £195,000 from the Northstar EIS Growth Fund, alongside £500,000 from fellow investors Smartlink. The business has also been awarded a grant via Innovate UK’s investor partnership programme. Nanovery has developed a versatile platform of analytical tools that are used in the development of a new class of drugs known as RNA therapeutics. These are opening the door to addressing previously untreatable diseases, including several cancers, and as such there is growing interest in the potential of this new class of drug. It is estimated that the rapidly growing RNA therapeutics market will surpass $20bn by 2030, with over 1,000 companies believed to be developing this class of drugs and in the region of 2,000 new candidates in pre-clinical and clinical phases of development.

RNA therapies offer several advantages including the ability to design and develop new drugs (with potentially fewer side effects) more quickly than conventional methods. However, the stability of RNA molecules and the ability to deliver them to the intended site are common hurdles for this type of treatment. It is therefore essential to able to quickly and reliably test the bioavailability of the drug which has previously been a challenge. The existing testing technologies are complex, costly, time consuming and require high technical ability and expensive equipment. And the conventional analysis techniques do not deliver the necessary accuracy or sensitivity for reliable test results.

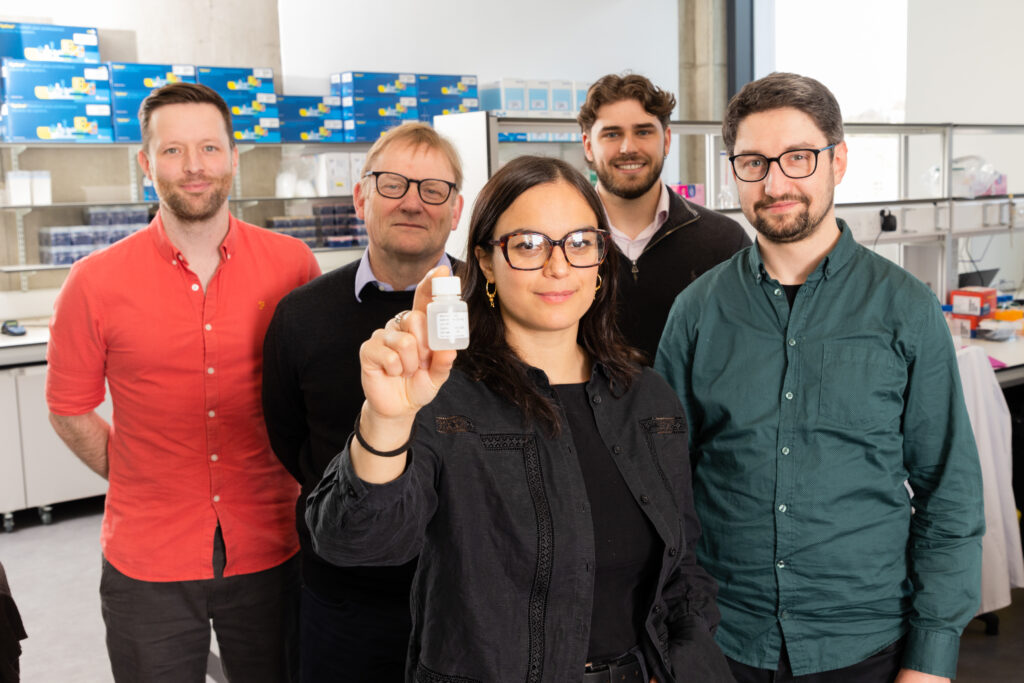

The Nanovery platform provides the ability to test at very low concentrations in a simple reaction using only standard laboratory equipment delivering reliable results quickly and cost effectively. This advance in testing technology offers the potential for more drugs to reach the clinic more quickly. The advantages of Nanovery’s technology mean that it is very well positioned to become the favoured approach for bioanalysis of this class of drugs. The company has already closed R&D deals with some household names which bodes well for the future.

Alex Buchan, Investment Director, Northstar Ventures, says: “The technology which Nanovery has produced is incredibly promising. It can address real industry issues easily and cheaply in the fast-moving arena of diagnostics and drug development. We have backed Nanovery from very early on and are proud to support them in their work to develop novel therapeutics. Nanovery is one of a number of companies in the North East that are at the cutting edge of the use of synthetic biology to find new solutions to seemingly intractable problems in the development of new patient therapies.”

Jurek Kozyra, CEO, Nanovery, says: “Securing this investment is a significant milestone for Nanovery and positions us to make a real difference in how next generation drugs – specifically ASOs and siRNA – are developed and tested. Nanovery’s technology makes the testing process simpler, quicker, and more reliable. And we couldn’t make it any easier: just add our nanorobots directly to the samples, measure fluorescence, and get results – bam, bam, bam – enabling drug developers to rapidly and reliably perform bioanalysis.

“We’re thrilled by the growing enthusiasm from our investors, which is reflected in the bold strides we’re making to commercialise our technology with leading global industry players, including top pharmaceutical companies. We’re determined to keep accelerating the growth and adoption of our cutting-edge nanotechnology platform, believing it will help bring the most promising, life-changing therapies to patients faster. We are incredibly thankful to all the investors who have supported us on this journey.”

Notes To Editors

Press contacts – Northstar Ventures Limited

Deborah Nixon Carr

Marketing / Investment Support

M: 07754 800 749

[email protected]

Emma O’Rourke

Finance Director

M: 07715 366 434

[email protected]

About Northstar Ventures

Northstar Ventures is a long-established venture capital company based in the North East of England.

As the region’s leading early-stage investor, we have provided over £100m of funding into start-ups, early-stage businesses and high impact social enterprises.

Supporting entrepreneurs since 2004, we know how to identify strong, effective teams with innovative ideas that will drive high growth, scalable businesses, and sustainable charities. Our particular focus is on those organisations who provide solutions to societal and industry-wide issues on a regional, national and even global scale.

Our investment managers have a wealth of expertise supporting new and growing businesses. They bring commercial and operational knowledge to the table combining everything from PhDs, MBAs, international careers and finance to micro-business experience.

Northstar Ventures Limited is authorised and regulated by the Financial Conduct Authority. For more information see www.northstarventures.co.uk.

About the Northstar EIS Growth Fund

The Northstar EIS Growth Fund is a tax-efficient fund that offers investors the opportunity to invest in innovative businesses with high growth potential. The fund provides growth capital for scale up businesses with good commercial traction and proven demand and which are rapidly establishing their position in the market.

About Nanovery

At Nanovery, our cutting-edge DNA nanorobots are revolutionising the biotechnology landscape. As pioneers in nucleic acid nanorobotics (NANs), our platform is the first to provide comprehensive solutions for RNA therapeutic analysis and biomarker quantification. This innovation elevates research precision and simplifies testing protocols.

Our mission is to make the testing processes as simple as possible to drive advancements in biotech research. Nanovery’s NANs technology is not just part of biotechnology’s future; it is actively shaping it, ensuring our partners stay at the forefront of innovation.

Editor’s notes:

Media contacts:

Kristen Watson

PR Account Executive

T: 0191 261 4250

M: 07718 065696

Sarah Banks [email protected]

Jez Davison [email protected]

About The North East Fund

The North East Fund is a suite of five venture capital and loan funds which was established in April 2018, to invest £130m in around 600 North East businesses in the period to December 2023. The fund managers provide business development advice and investment finance to small and medium sized enterprises based in the seven Local Authority areas of North East England: Northumberland, North Tyneside, Newcastle, South Tyneside, Gateshead Sunderland and County Durham. The programme encourages investment in and the commercialization of new technologies, including low carbon technologies, as well as stimulating new business creation, private investment and entrepreneurialism in the North East, with a view to creating over 2,500 new jobs. The North East Fund has overall responsibility for the programme, which is delivered through five separate funds, each managed by independent, FCA regulated fund managers. Details of these, and up to date information on the progress of the programme, is available on The North East Fund’s website: www.northeastfund.org.

The North East Fund has been established with funding from the North East of England European Regional Development Fund programme, the European Investment Bank and from returns on previous North East based, publicly supported investment funds. It is jointly owned by the seven North East local authorities.

About the European Regional Development Fund

The North East Fund will receive up to £66,500,000 of funding from the England European Regional Development Fund as part of the European Structural and Investment Funds Growth Programme 2014-2020. The Department for Levelling Up, Housing and Communities is the Managing Authority for the European Regional Development Fund. Established by the European Union, the European Regional Development Fund helps local areas stimulate their economic development by investing in projects which will support innovation, businesses, create jobs and local community regeneration.

For more information visit: https://www.gov.uk/european-growth-funding

About the European Investment Bank

The European Investment Bank (EIB) will lend up to £60,000,000 to the North East Fund programme. The European Investment Bank is the long-term lending institution of the European Union owned by its Member States. It makes long-term finance available for sound investment in order to contribute towards EU policy goals.

For more information, visit: http://www.eib.org/about/index.htm