Northstar Ventures has led a £1.7m investment round, via its Venture Sunderland Fund, into Lithium Salvage, who plan to build a pioneering refinery for waste Lithium-ion household battery materials based in Sunderland.

The volume of waste generated from Lithium-ion household batteries used in items such as power tools, mobile phones and vacuum cleaners is already significant and likely to grow much further. Much of this waste is currently sent overseas for processing due to a lack of domestic capacity. These batteries contain valuable metals such as lithium, manganese, cobalt and nickel that can be recovered and reused. The recycling of these materials is a critical component of the government’s ambition to improve the UK’s self-sufficiency in terms of critical material wastage.

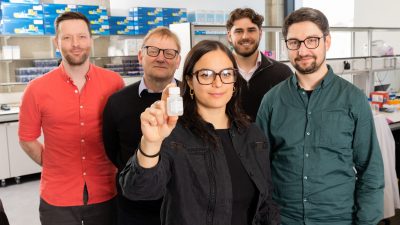

Lithium Salvage has developed a proprietary, scalable and environmentally sustainable refining process to recover these metals as salts that can be sold through trading partners. The company has ambitious plans to be the only end-to-end household Lithium-ion battery recycler in the UK by 2026. To date, the business has been supported by Innovate UK and collaborations with Teesside University, the Centre for Process Innovation, GAP Group, Pennine Energy and 6th Engineering.

This funding round will support the scale up of the production process and enable the expansion of its Sunderland site. Additional investment is from Sixth Wave Ventures, NPIF II – Maven Equity Finance, which is managed by Maven as part of the Northern Powerhouse Investment Fund II (“NPIF II”), supported by the British Business Bank, Gaspara Asset Management, and business angel investors from across the UK.

Tom O’Neill, Investment Manager, Northstar Ventures said: “We are extremely pleased to lead this round of investment in Lithium Salvage as the second deal from our Venture Sunderland Fund. The Fund looks to support high-potential businesses that are seeking to start up or grow in Sunderland. Lithium Salvage is tackling a major environmental issue, whilst establishing a pioneering household Lithium-ion battery materials recycling facility in the Sunderland city region that builds on its strengths in battery technology and electrification. We look forward to working with them to achieve this vision”.

Simon Robeson, Chairman and Founder said: “Today’s funding announcement is a further vote of confidence in our vision, our technical capabilities and our mission to create a scalable and ecologically sound supply chain for recycled Lithium-ion battery materials.”

Duncan Noble, CEO said: “Li-Sal’s proprietary process delivers a sustainable, market-leading solution to the escalating UK need to recycle waste Lithium-ion batteries without creating other waste streams or shipping these valuable metals abroad.”

Michael Dickens, Investment Manager Maven Capital Partners said: “We’re delighted to support Li-Sal with its plans to commercialise a UK refinery for waste Li-Bat materials. Simon and the team have built an impressive business and we look forward to supporting them as they seek to operate the UK’s first end to end household appliances Lithium-ion battery recycling facility based in Sunderland.”

Sarah Newbould, Senior Manager at British Business Bank said: “Innovative organisations that contribute to the green economy are exactly the type of businesses that NPIF II aims to empower through making finance more accessible to Northern entrepreneurs. This investment demonstrates how funding can generate a wider positive impact beyond business and create a more sustainable future for everyone.”

Notes To Editors

Press contacts – Northstar Ventures Limited

Deborah Nixon Carr

Marketing / Investment Support

M: 07754 800 749

[email protected]

Emma O’Rourke

Finance Director

M: 07715 366 434

[email protected]

About Northstar Ventures

Northstar Ventures is a long-established venture capital company based in the North East of England.

As the region’s leading early-stage investor, we have provided over £100m of funding into start-ups, early-stage businesses and high impact social enterprises.

Supporting entrepreneurs since 2004, we know how to identify strong, effective teams with innovative ideas that will drive high growth, scalable businesses. Our particular focus is on those organisations who provide solutions to societal and environmental issues on a regional, national and even global scale.

Our investment managers have a wealth of expertise supporting new and growing businesses. They bring commercial and operational knowledge to the table combining everything from PhDs, MBAs, international careers and finance to micro-business experience.

Northstar Ventures Limited is authorised and regulated by the Financial Conduct Authority. For more information see www.northstarventures.co.uk.

About the Venture Sunderland Fund

The Venture Sunderland Fund provides investment for ambitious, high-growth companies at all stages. The fund has been established to invest in companies that will catalyse the economic growth and prosperity of the Sunderland city region.

Venture Sunderland is primarily focused on businesses in technology, advanced manufacturing and green industries that are focused on growth and creating high-quality, well-paid jobs in the city region.

Sunderland is a leading digital and creative hub, nationally recognised as a Smart City with an automotive sector that is leading the UK’s switch to electrification. One of the key aims of the Venture Sunderland Fund is to accelerate the area’s development as an innovation hub for the wider north of England.

For further information on the Venture Sunderland Fund, see Venture Sunderland Fund – Northstar Ventures

About Lithium Salvage:

Li-Sal has developed a proprietary, scalable refining process which represents a breakthrough in the climate friendly recovery of valuable materials from waste Lithium-ion batteries including Lithium, Manganese, Cobalt, and Nickel. With raw material shortages and environmental pressures driving up costs, Li-Sal’s sustainably recovered materials offer a solution for industries seeking economic resilience, environmental compliance and end-product differential. Li-Sal’s progress was fuelled by a £940k Innovate UK grant in 2023, which continues to support Li-Sal’s collaborations with Teesside University, the Centre for Process Innovation, GAP Group, Pennine Energy, and 6th Engineering. For further information on Li-Sal, see Lithium Salvage

About Maven Capital Partners UK LLP www.mavencp.com

Maven Capital Partners is one of the UK’s leading private equity firms, specialising in investments in high-growth British companies. With a focus on innovation and value creation, Maven partners with visionary entrepreneurs to build market-leading businesses, supporting a range of transaction types, including management buyouts, growth capital, buy and build projects, equity value release and pre-IPO financing.

About the Northern Powerhouse Investment Fund II

- Operated by the British Business Bank, the Northern Powerhouse Investment Fund II (NPIF II) provides a mix of debt and equity funding. NPIF II will offer a range of commercial finance options with smaller loans from £25k to £100k, debt finance from £100k to £2m and equity investment up to £5 million. It works alongside the Combined Authorities, Local Enterprise Partnerships (LEPs), and Growth Hubs, as well as local intermediaries such as accountants, fund managers and banks, to support the North’s smaller businesses at all stages of their development.

- The funds in which the NPIF II invests are open to businesses with material operations, or planning to open material operations, in: Cheshire, Cumbria, Greater Manchester, Lancashire, Merseyside, City of Kingston upon Hull, East Riding of Yorkshire, North Yorkshire, South Yorkshire, West Yorkshire, Hartlepool and Stockton-on-Tees, South Teesside, Darlington, Durham, Northumberland, Tyneside, Sunderland.

For investment by NRIL at the sub-fund level

- The investment from the Nations and Regions Investments Limited into Lithium Salvage UK Ltd. does not amount to any endorsement or warranty from Nations and Regions Investments Limited, the British Business Bank plc or the government of the United Kingdom.

For investment by NPIF II sub-fund at the investee company level

- The investment from the Northern Powerhouse Investment Fund II into Lithium Salvage UK Ltd. does not amount to any endorsement or warranty from Nations and Regions Investments Limited, the British Business Bank plc or the government of the United Kingdom.

Smaller Loans from £25,000 to £100,000 – GC Business Finance & River Capital (North West), Business Enterprise Fund (BEF) (Yorkshire and Humber) and NEL Fund Managers (North East).

Business Loans from £100,000 to £2m – FW Capital (North West), Mercia (Yorkshire and Humber) and NEL Fund Managers (North East).

Equity Finance up to £5m – Prateura Ventures (North West), Mercia (Yorkshire and Humber), and Maven Capital Partners (North East).

Applications for funding are made directly to the relevant fund managers who can be contacted via the NPIF II webpages www.northernpowerhouseinvestment fund.co.uk